If you are claiming this relief for the first time please email us the completed Handicapped-Related Tax Relief form DOC 243KB. This tax incentive is available until assessment year 2025.

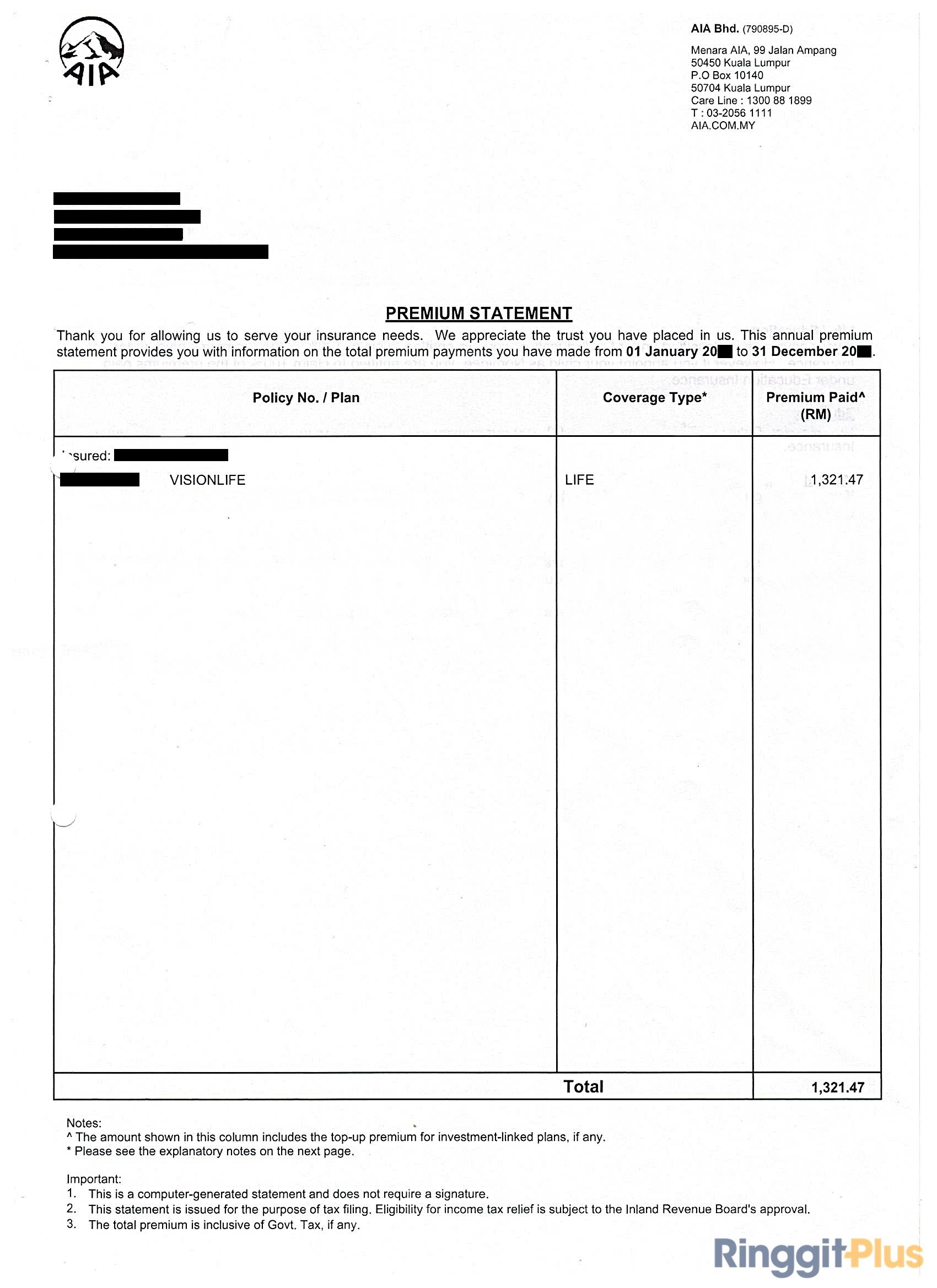

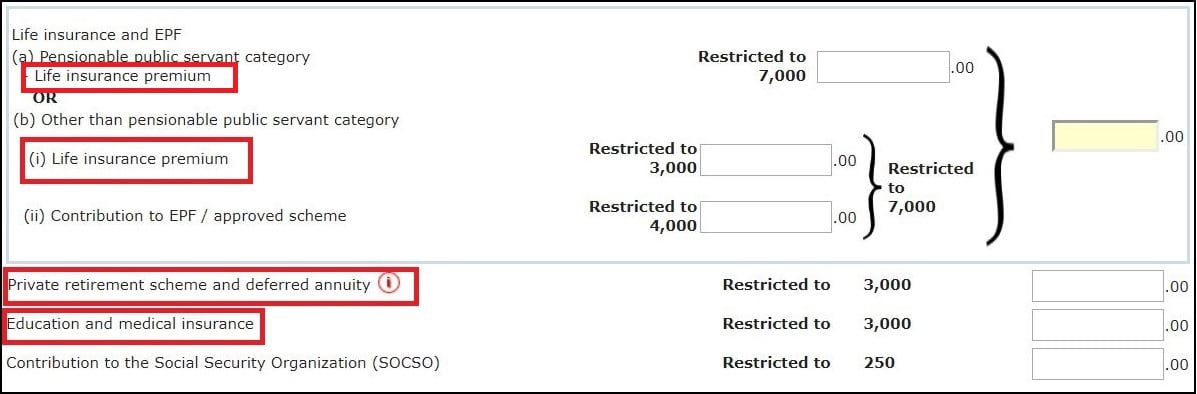

How To Claim Income Tax Reliefs For Your Insurance Premiums

Find out why we are the UKs fastest growing SSAS provider.

. PRS Income Tax Relief. The total personal income tax relief claimable in a year from the Year of Assessment 2018 is S80000. While Mr Ong would like to make a cash top-up of 8000 to his mothers CPF Retirement Account and the amount of top-up allowed to be made is 8000 no tax relief is given for the cash top-up as her Retirement Account savings have already reached the Full Retirement Sum.

Besides being an additional retirement pot the PRS is also income tax deductible. The PRS Tax Relief was specially introduced to encourage you to save more for your retirement. I have received my tax bill for the current Year of Assessment.

Earnings generated by the PRS funds will. Your annual allowance is the most you can save in your pension pots in a tax year 6 April to 5 April before you have to pay tax. Computation table is for illustration purpose only.

The good news is an individual who makes contribution to his or her PRS funds is allowed to claim personal tax relief of up to RM3000 by the Inland Revenue Board of Malaysia. Heres an illustration of how much you could save in taxes. You will be able to deduct up to RM3000 from your taxable income which will count towards your final tax payable.

It shows that I have been given Parent Relief on my mother. SRS contributions made on or after 1 Jan 2017 help maximise the total amount of tax relief you can claim. Developed using ground breaking technology rated outstanding by you our customers we deliver a seamless fast and better self administered pension scheme for you and your wealth.

Plus youll get a 25 top up on each contribution up to 32000 or 100 of your salary whichever is lower thanks to tax relief. That means if you add 800 to your personal pension tax relief will take this amount up to 1000 and best of all you dont have to do a thing. Youll only pay tax if you go above the annual allowance.

What To Do With Your Pension When Leaving An Employer Manulife Investment Management

Prs Faq Private Pension Administrator Malaysia Ppa

Beginner S Guide To Private Retirement Schemes Prs In Malaysia

60 Tax Relief On Pension Contributions Royal London For Advisers

Prs Faq Private Pension Administrator Malaysia Ppa

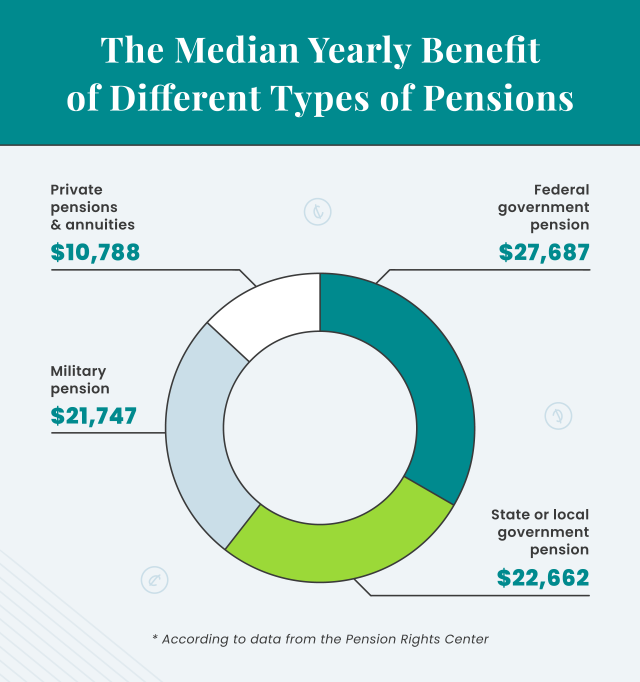

Average Retirement Income Where Do You Stand

Private Retirement Scheme Principal Asset Management

Private Retirement Scheme Principal Asset Management

A Guide To The Private Retirement Scheme Prs

How To Claim Income Tax Reliefs For Your Insurance Premiums

Tax Savings For 2021 Top Tax Reliefs Deductions You Must Not Miss Outefore Year End Yau Co

What Is Pension Tax Relief Moneybox Save And Invest

Pension Tax Relief Calculator Taxscouts

Tax Savings For 2021 Top Tax Reliefs Deductions You Must Not Miss Outefore Year End Yau Co

Tax Savings For 2021 Top Tax Reliefs Deductions You Must Not Miss Outefore Year End Yau Co

Lhdn Irb Personal Income Tax Relief 2020

60 Tax Relief On Pension Contributions Royal London For Advisers